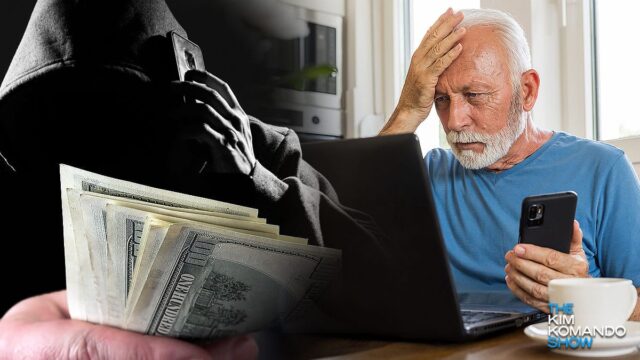

Elder fraud is on the rise – These are the most common scams

Here’s a stat that blows me away: One in every 10 seniors is a victim of identity theft each year. Americans over the age of 60 lost $3.4 billion in fraud schemes in 2023. That’s almost an 11% increase from the year before, and things are only getting worse.

As much as 68% of elder fraud cases start with personal information that’s leaked online. (I use Incogni to fix that problem for me, but more on them later.) Let’s dive into which scams hit the hardest and what you and your loved ones can do about it.

A troubling trend

Things aren’t looking any better this year, by the way. From January to May, $1.6 billion in elder fraud losses were reported to the FBI’s Internet Crime Complaint Center (IC3) — almost $300 million more than during the same stretch last year.

So, why do criminals target older adults? It all comes down to money. Crooks rightly assume many older folks have a bigger nest egg and own real estate.

Older adults are also less likely to report fraud, especially when they feel ashamed. For every case of elder fraud reported, as many as 44 cases aren’t. If they do want to report it, many scam victims don’t know where to start and stall out after contacting their local police department.

Worst of the worst

Here are the top reported elder fraud schemes, according to the FBI:

- Tech support scams: Fraudsters pose as tech support agents to trick victims into handing over personal info or paying for scam services.

- Data breaches: Everything from passwords to Social Security numbers end up posted for sale on Dark Web marketplaces.

- Romance scams: Scammers woo their targets and manipulate their emotions to get their money.

- Investment scams: Promises of high returns from trading everything from crypto to real estate with little risk, all that go bad.

- Non-payment or non-delivery scams: Victims order something online and then receive a cheap imitation or nothing at all.

- Government impersonation scams: Bad guys pretend to be police, IRS agents, Medicare employees and others in positions of power.

In 2023, tech support scams were the most widely reported type of elder fraud. Roughly 18,000 victims ages 60 or older reported incidents to the IC3. Investment scams were the costliest, with a staggering $1.2 billion in losses.

‘Yikes, OK. What can I do about it?’

Be on the lookout for the common warning signs of a scam, such as unsolicited calls or texts, strangers contacting you on social media, requests for personal information, offers that sound too good to be true, pressure to act quickly, and demands for payment through unconventional methods (e.g., gift cards, gold bars or wire transfers).

You already have a head start over scammers because you read my newsletter. Staying informed about their latest tricks and tactics is one of the most important things you can control.

What about all the things you can’t control?

… Like when companies leak your data to anyone and everyone? That’s where Incogni comes in.

Think of Incogni as your personal privacy service. They find all the people-search and data-broker sites your info is listed on, and then they submit requests to remove you. It all happens automatically after you set up your Incogni account.

So far, Incogni has wiped my personal info from 380 creepy databases, saving me an estimated 285 hours. Even better, they make sure my info stays off for the long haul.

✅ Right now, while you’re thinking about it, let Incogni do the work to protect your privacy. I negotiated a deal just for you: 60% off. Stop waiting. I’m sure glad I did. A wonderful bonus: My scam calls and texts are down to zero.

Tags: fraudsters, internet, numbers, online, privacy, scams/scammers, security, seniors, social media, Target, tech, warning