These apps save you money, but are you giving away your privacy?

When streaming first hit the scene, it promised a convenience revolution that would free us from the burden of cable subscriptions. There’s a downside, though: Now, we have a ton of streaming services to keep track of. It’s so easy to sign up for a bunch of platforms — only to forget about them a few months down the line.

Next thing you know, you realize you’ve been paying over $10 a month for shows you never even watched! Tap or click here for three easy ways to manage all your streaming services without driving yourself bonkers. Another great way to trim the fat is to track and manage your paid subscriptions with an app.

These apps can keep tabs on what you’re spending and even help you save money. They can notify you when prices spike, identify services you’re no longer using — and track your data. Although they sound great, some of them may pose a risk to your privacy, so here are some helpful tips to protect yourself.

1. Use the best app for your needs

Some apps, like Trim, dip into your financial records to automatically identify your subscriptions. Others require you to enter your information manually. You can also find alternatives that come with extra tools, like budgeting programs or even investment opportunities.

It’s always a good idea to go through each app at your disposal. Don’t just select the first option you see. Make sure you’re using the best one for your needs.

One good way to do this is to write down each feature you’re interested in. Do you just want a free app that shows your costs and lets you know when the service is due to renew? Then you might be interested in TrackMySubs.com, which comes with a free tier that tracks up to 10 services and holds10 MB of storage.

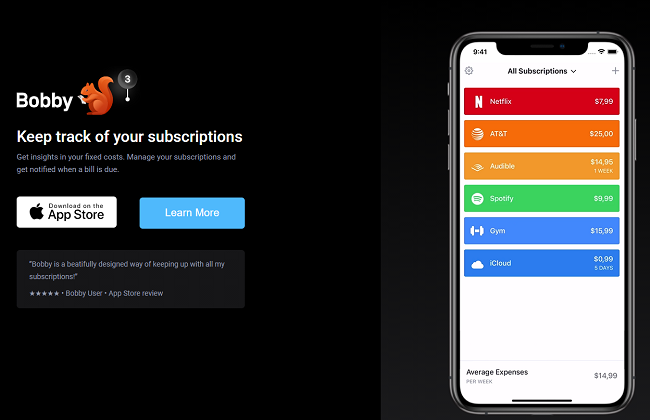

If you’re a little leery of linking a smartphone app to your bank account, check out Bobby. You can sync data through iCloud and secure the app with Face ID, Touch ID or a strong passcode. The Bobby app is only available for Apple devices and you can get it here.

Speaking of passwords, make sure you follow this critical next step.

2. Create strong and original strong passwords

Since these apps are connected to your most sensitive information, you need strong passwords to keep out potential invaders. You wouldn’t believe how many people think weak codes like “password1” can protect their online accounts. Here are some tips to protect your privacy and security:

- Use a complex combination of letters, numbers and alternating capitalization. The more random or complex your password appears, the harder it will be to guess.

- Create passwords based on a secret phrase: Write a sentence, then abbreviate it. For example, “Cubs won the World Series in 2016.” Next, replace certain letters and numbers with other characters. Alternate between capital and lower case. For example, cUb$W1nW0rLd$3r13$1NzOI6. Tough to crack, right?

- Use two-factor authentication: 2FA ties your account access to something only you possess. That means only you can get into your account.

- Never repeat the same password: If you use the same password across multiple sites, change them up ASAP. If one website suffers a security breach, hackers will steal that password, try it on other sites and slowly take over all your accounts.

Tap or click here for more imaginative ways to create strong passwords.

3. Don’t fall for free trial scams

Tricksters often lure you in with the offer of free services and products … only to bite a chunk out of your bank account later on. Often, they’ll bury the charges in the fine print.

Plus, you should remember that even legitimate apps that let you sign up for free may charge for upgrades or services. Bottom line: Make sure there aren’t any hidden charges that could bite you in the back.

Speaking of which, we’ve got nine insider streaming tips to help you save money. Tap or click for affordable access to the content you want.

4. Make sure you’re saving money, instead of overspending on apps

If you decide to buy a paid service, take a step back and think about how much money it will really help you save. You might end up paying so much for the app that the amount outweighs the cash you’re saving on streaming apps. In this case, look for a cheaper app.

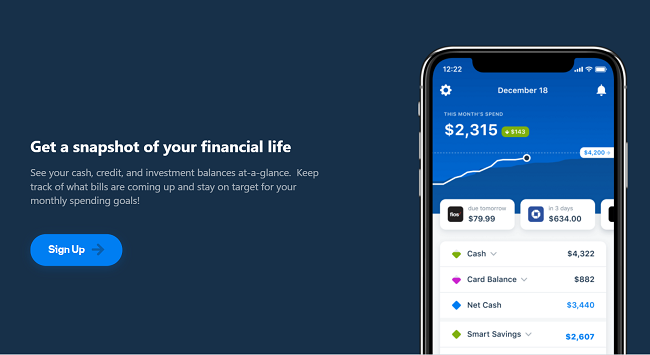

One great option is Truebill, which you can get on Android or Apple smartphones. It links to your bank account, automatically fills in your financial data and creates a custom dashboard for you.

This colorful app helps you set up a budget, keep track of your spending habits and even set up a savings account. Plus, you can add alerts and cancel unwanted subscriptions — all through Truebill. Although its premium account costs $3 a month, you can stick with the free version.

The free Truebill app is available for both Apple and Android devices. Get it for iOS here or Android here.

5. Don’t give your data to a site you haven’t screened

Subscription management apps handle a ton of sensitive information. They identify the services you’re paying for and tell you which subscriptions can be canceled. Some of them will even keep track of payment dates.

That’s a lot of responsibility. These apps need access to your financial records and your bank account. While many of these apps are safe, you should always do your research before handing over the keys to your kingdom.

Otherwise, you could put yourself at risk of identity theft. For example, there’s been an enormous influx of fraudulent unemployment claims in recent months, and criminals were paid out as much as $36 billion in 2020 alone. Tap or click here to see how scammers could file for unemployment in your name.

Keep reading

14 tech gadgets that do all the hard work for you

Scam alert: Don’t fall for this free Walmart giveaway

Tags: Android, Apple, hackers, security, streaming services, tech gadgets